Contents

The main downside of this broker relative to some of its competitors is that it lacks a major regulator, although it is overseen by 3 minor regulators. Depositing money into the ifc markets trading platform is easy. You just have to finish a single-user profile questionnaire to begin depositing money into your trading account. You’ll need to give an identity proof and proof of residency to deposit large amounts.

- Prior to making transactions one should get acquainted with the risks to which they relate.

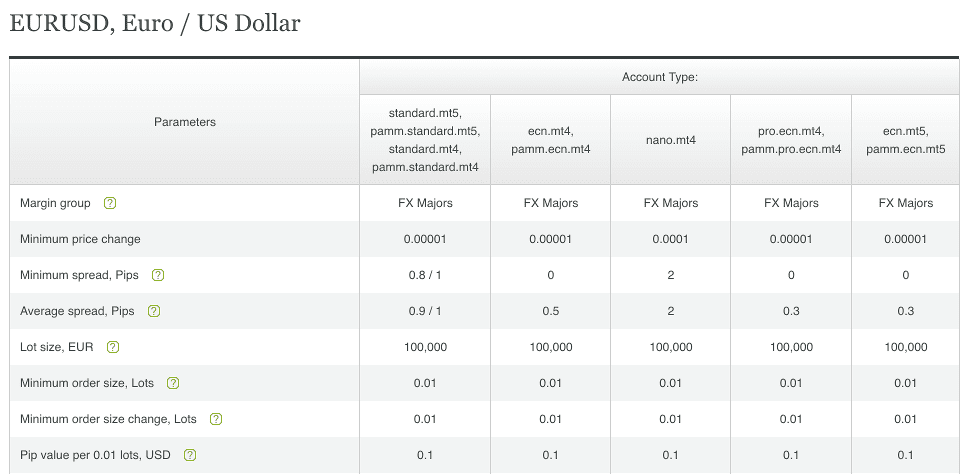

- Please be informed, that the spread on accounts with floating spreads is a market spread, meaning it can fluctuate depending on the market conditions.

- If you are on this page it’s that you are victims of IFC Markets.

Money withdrawal with ifc markets is quite fast, according to regulations it’s a few hours, but in actuality I get the payments within minutes, which makes me happy. I got an account here out of pure interest cause I wanted to see what nettradex and geworko were. I deposited a bit of money, tested the execution and withdrawal. Everything was working well, so I decided to get a bigger deposit. Now this is my main broker and I have no problems trading with it.

IFC Markets Reviews and Comments

Yes, ifc markets offers customer support over the telephone. Skrill also offers cross-border payments through its remittance service Skrill Money Transfer. Customers can transfer money to a bank account in another country by using their https://forexbroker-listing.com/ credit card. Skrill became part of the Paysafe Group along with former competitor Neteller and the prepaid payment company paysafecard. For other trading platforms, the inactivity fee depends upon the type of account you have selected.

I like the trading environment at IFC Markets, as it supports algorithmic trading on all its trading platforms. It offers traders the ability to create synthetic assets via its patented Portfolio Quoting Method. Traders benefit from high leverage, excellent research, and quality education but face a minimum deposit of $1,000. IFC Markets offers traders a competitively priced environment especially if they are willing to trade on the proprietary NetTradeX platform. In addition to providing top-quality trading platforms that include MT4/5, the broker provides an impressive market education section on its website.

If you would like to earn profits, you should trade with a brokerage service that aligns with your investing objectives. The money is deposited securely into your account without any worries about safety. You can quickly deposit and easily withdraw funds to your account through wire transfers, credit cards and online apps. There are no fees for depositing or withdrawing money on the IFC Markets trading platform.

This can be beneficial for people who regularly exchange, such as weekly or daily trading. At the time of writing this ifc markets review, and despite ifc markets’s impressive offering, the company has surprisingly not garnered any awards to date. Ifc markets gives access to customer support over livechat. The agent goes to great lengths to understand what dealers need. The broker also gives a variety of platforms for all types of traders.

Broker Types

The operator of this website does not verify this information and is not responsible for its accuracy, completeness, timeliness, truthfulness or the compliance of a broker with legal regulations. Please verify whether the broker is authorized to provide its services in your country of residence in accordance with the legal regulations that apply to its business. It is also pity that this is actually a problem because there are other forex brokers out there that may not incorporate Skype into their customer service line up but still treat their clients with respect. They also show willingness to do what they can to resolve your issues as quickly as possible. IFC Markets customer service agents on the other hand are the complete opposite of this. IFC Markets offers competitive dealing spreads and provides clients with excellent support.

It majorly owes this standing to its unbelievable platform and broad range of tools plus resources so you may put money into capital markets. Even so, ifc markets doesn’t have assured stop-loss protection. You can drop all your worries because we believe that ifc markets is perfectly safe to use. We have scoured the web to find the best alternatives to ifc markets. We called ifc markets and the call was answered extremely promptly. In the event you’re withdrawing money in different currencies from USD, a conversion fee is also important.

One of IFC Markets’ most notable features is its proprietary GeWorko Portfolio Quoting Method that allows you to create and trade your own financial instruments. You can also trade the personal composite instruments created by the IFC Markets team. These include a high-tech index, gold versus Brent oil, the DJIA versus the euro, and the Russian ruble versus the Japanese yen. Payoneer’s customer service team includes 320 employees that support 4,000,000 customers in 70 languages and in 150 currencies. Skrill has several licenses enabling it to offer its services across Europe and globally. Skrill is run through Paysafe Payment Solutions Limited, an entity that is incorporated in Ireland and regulated by the Central Bank of Ireland, for its European regulated operations.

The broker accepts also deposits with the most popular crypto, the BTC. IFC Markets does not charge any fees for deposits (please note that banks or/and e-wallet providers may charge a transfer fee). I heard about this broker a few times from an acquantance, but only recently have tried it myself.

How can I start trading with ifc markets?

IFC Markets is a regulated Cyprus broker that provides access to trading a wide range of Forex and CFD instruments. The business model is based on transparent and trusting relationships with customers using STP technology on various platforms, including a proprietary platform with powerful features. In addition, the broker offers training and customer service in several languages, as well as trading accounts with floating and fixed spreads. A good broker constitutes a good service for traders in terms of many criteria including trading instruments, deposits and withdrawals, as well as customer support. What is good for a certain trader does not necessarily mean the same thing to you.

Furthermore, deposits and withdrawals are processed in real time, which makes them safe and secure. IFC Markets offers trading via the MT 4 and MT5 as well as its own developed NetTradeX advanced trading platform. Due to our unique relationship with many brokers, we have often mediated between brokers and clients in order to help successfully resolve client issues, including clients who are having withdrawal issues. Brokers are often very fast to respond to us, since we typically have many clients with them. Our knowledgeable support team is available 24 hours per day in 8 native languages & 23 total languages for any questions.

Is IFC Markets safe?

It is 5 years I trade with IFC Markets and don’t want to change the broker. IFC Markets pays annual interest on free account margin. The rate depends on the monthly trading volume, rewarding active traders with transactions exceeding 10 lots monthly. High-frequency traders may benefit from this passive income offer and offset swap rates on leveraged overnight positions. There are several platforms to choose from when investing with IFC Markets. These two are the industry standard for online forex and CFD brokers.

Ifc markets includes an extremely professional and full-featured trading site that is focused on forex, indices, metals, shares, commodities. Please be informed that we offer both fixed spread started from 1.8 and floating spreads started from 0.4, commission is charged only on stock CFDs. Spread depends on the market conditions and may temorary increaed due to high volatility or low liquidity. IFC Markets’ customer support is available through email and live chat. Customers can contact the broker using different languages. In addition to the website’s general FAQs, there are tutorials for several different platforms that traders may use to trade with IFC Markets.

So be sure to verify applicable conditions according to your residence and other laws as well. Inactivity fee – Currently, IFC Markets does not charge any inactivity fees or account maintenance fees. PCI Library – 37 CFDs, created by the analysts of IFC Markets exclusively for the NetTradeX terminal – including some interesting pairs such as BRENT/NOK, OIL/GAS, Wheat/RUB, WTI/JPY and XAG/MXN. Cryptocurrencies – 2 cryptocurrencies CFDs crosses for trading versus the USD – BTC and ETH. ETFs – 4 ETFs CFDs, including US iShares real estate, tracking the overall performance of a basket of shares of several sectors.

Last week was just great, make a good amount of money, decided to withdraw and, low and behold! The money arrived within virtually 20 minutes, anyway, it was so cool, didn’t expect such speed of withdrawal. Spread is average, ifc markets review but fixed, not very good for fast trade of course, but for midterm it’s fine. There’s nothing to scold this company for, they let you trade and earn, the terminal works appropriately, the quotes are market quotes.